New York State Clean Heat Pump Program – Con Edison Territory

Attention Westchester & NY City Residents – Bronx, Brooklyn, Queens and Manhattan

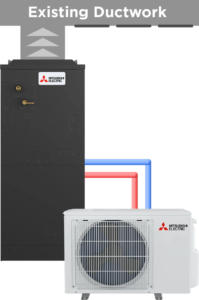

Residential Incentives for Air Sourced Heat Pumps

Residential Incentives for Air Sourced Heat Pumps

Category 2B – Full Load Heating with decommissioning

- Single Family Home = $8,000

- 2-4 family building & per individual Dwelling = $3,000

Residential Incentives for Heat Pump Hot Water Heaters

Decommission your oil or gas hot water heater and get $1,000 instant rebate through Con Edison’s Midstream Heat Pump Water Heating Program.

Why Choose Breffni Mechanical?

Breffni Mechanical Inc can save you the hassle of hiring 3 different contractors to convert your home to electric. We can install your air sourced heat pump for heating and cooling your home AND install an ENERGY STAR certified heat pump hot water heater and upgrade your electrical panel accordingly.

You can receive a tax credit and a rebate for the same project. (You can apply for the Energy Efficient Home Performance Credit –section 25C – on your 2023 tax returns.)

Tax Credit

- The Inflation Reduction Act (IRA) of 2022 provides for federal income tax credits for the installation of qualifying heat pumps.

- You can apply for the Energy Efficient Home Performance Credit –section 25C – on your 2023 tax returns.

- You will be eligible to receive 30% of the cost, up to $2,000, as a tax credit. You would report the amount paid or incurred during the taxable year, i.e. the installation cost after the incentive has been applied to determine the 25C tax credit’s maximum value.

- Under the same tax provision, households can save 30 percent of the cost of electric service upgrades associated with heat pump installation, deducting up to $600 annually. The credit covers improvement to, or replacement of, a panelboard, sub-panelboard, branch circuits, or feeders that have a load capacity of at least 200 amps.

- The credits are available only for improvements made to the taxpayer’s principal residence. (Not for 2nd homes that are not taxpayers principal residence.)

- You must have sufficient federal tax liability to receive the credits.

- You can receive a tax credit and a rebate for the same project.

- It would be beneficial to consult with your tax advisor prior to moving forward with the install.

- Click here to see more information direct from IRS website.